How Much Of The Money Taken By The Irs Is Used By The Irs

| IRS | |

| |

| Agency overview | |

|---|---|

| Formed | July one, 1862 (1862-07-01) [1] (though the name originates from 1918) |

| Type | Revenue service |

| Jurisdiction | Federal authorities of the United States |

| Headquarters | Internal Acquirement Service Building 1111 Constitution Ave., NW Washington, D.C. 20224 United States[ii] |

| Employees | 74,454 (FTE) (2019)[three] |

| Almanac upkeep | $11.303 billion (2019)[4] |

| Agency executive |

|

| Parent agency | Department of the Treasury |

| Website | world wide web |

The Internal Acquirement Service (IRS) is the revenue service for the Usa federal government, which is responsible for collecting taxes and administering the Internal Acquirement Code, the main body of the federal statutory taxation law. It is function of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax aid to taxpayers; pursuing and resolving instances of erroneous or fraudulent revenue enhancement filings; and overseeing diverse benefits programs, including the Affordable Intendance Human activity.[v]

IRS Edifice in Washington D.C.

IRS location sign on Constitution Avenue, Washington, D.C.

The IRS originates from the Commissioner of Internal Revenue, a federal function created in 1862 to appraise the nation's first income taxation to fund the American Civil War. The temporary measure provided over a 5th of the Union's war expenses before being allowed to expire a decade later on. In 1913, the Sixteenth Subpoena to the U.S. Constitution was ratified authorizing Congress to impose a taxation on income, and the Bureau of Internal Acquirement was established. In 1953, the bureau was renamed the Internal Revenue Service, and in subsequent decades underwent numerous reforms and reorganizations, most significantly in the 1990s.

Since its establishment, the IRS has been responsible for collecting most of the revenue needed to fund the federal government, albeit while facing periodic controversy and opposition over its methods, constitutionality, and the principle of revenue enhancement generally. In recent years the agency has struggled with upkeep cuts and reduced morale.[6] As of 2018, it saw a fifteen per centum reduction in its workforce, including a turn down of more than than 25 percent of its enforcement staff.[7] However, during the 2017 fiscal year, the agency processed more than than 245 million revenue enhancement returns.

History [edit]

American Civil War (1861–65) [edit]

In July 1862, during the American Civil War, President Abraham Lincoln and Congress passed the Revenue Act of 1862, creating the function of Commissioner of Internal Revenue and enacting a temporary income tax to pay state of war expenses.

The Revenue Act of 1862 was passed as an emergency and temporary state of war-fourth dimension taxation. Information technology copied a relatively new British arrangement of income taxation, instead of trade and property taxation. The first income tax was passed in 1862:

- The initial rate was iii% on income over $800, which exempted most wage-earners.

- In 1862 the rate was 3% on income between $600 and $10,000, and 5% on income over $10,000.

By the stop of the war, 10% of Union households had paid some form of income tax, and the Union raised 21% of its war revenue through income taxes.[8]

Post Civil War, Reconstruction, and popular tax reform (1866–1913) [edit]

Subsequently the Ceremonious War, Reconstruction, railroads, and transforming the North and Due south war machines towards peacetime required public funding. However, in 1872, seven years after the war, lawmakers allowed the temporary Civil State of war income tax to expire.

Income taxes evolved, just in 1894 the Supreme Court declared the Income Tax of 1894 unconstitutional in Pollock 5. Farmers' Loan & Trust Co., a decision that contradicted Hylton v. Us.[nine] The federal government scrambled to raise money.[ten]

In 1906, with the election of President Theodore Roosevelt, and later his successor William Howard Taft, the The states saw a populist movement for tax reform. This motion culminated during then-candidate Woodrow Wilson's election of 1912 and in Feb 1913, the ratification of the Sixteenth Amendment to the United States Constitution:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment amidst the several States, and without regard to whatsoever census or enumeration.

This granted Congress the specific ability to impose an income taxation without regard to apportionment among the states by population. By February 1913, 36 states had ratified the modify to the Constitution. It was further ratified by six more states by March. Of the 48 states at the fourth dimension, 42 ratified it. Connecticut, Rhode Island, and Utah rejected the amendment; Pennsylvania, Virginia, and Florida did not take upwards the issue.[11]

Post 16th Subpoena (1913–nowadays) [edit]

Though the constitutional amendment to allow the federal government to collect income taxes was proposed past President Taft in 1909, the 16th Amendment was not ratified until 1913, but before the outset of the Outset World State of war. In 1913 the first edition of the 1040 form was introduced. A copy of the very get-go IRS 1040 form, tin can be constitute at the IRS website[12] showing that but those with annual incomes of at least $3,000 (equivalent to $82,300 in 2021) were instructed to file the income tax return.

In the outset year after the ratification of the 16th Amendment, no taxes were collected. Instead, taxpayers just completed the form and the IRS checked the course for accuracy. The IRS'due south workload jumped past ten-fold, triggering a massive restructuring. Professional taxation collectors began to supercede a organization of "patronage" appointments. The IRS doubled its staff merely was still processing 1917 returns in 1919.[13]

Income revenue enhancement raised much of the coin required to finance the war endeavour; in 1918 a new Acquirement Act established a top tax rate of 77%.

People filing tax forms in 1920

In 1919 the IRS was tasked with enforcement of laws relating to prohibition of booze sales and manufacture; this was transferred to the jurisdiction of the Department of Justice in 1930. Afterwards repeal in 1933, the IRS resumed drove of taxes on beverage alcohol.[14] The alcohol, tobacco and firearms activities of the agency were segregated into the Agency of Alcohol, Tobacco, Firearms and Explosives in 1972.

A new tax deed was passed in 1942 as the United States entered the Second Globe State of war. This human activity included a special wartime surcharge. The number of American citizens who paid income tax increased from about four one thousand thousand in 1939 to more than forty-two million past 1945.[15]

In 1952, later a series of politically damaging incidents of taxation evasion and blackmail amidst its own employees, the Agency of Internal Revenue was reorganized under a programme put forrard by President Truman, with the approving of Congress. The reorganization decentralized many functions to new district offices which replaced the collector's offices. Ceremonious service directors were appointed to replace the politically-appointed collectors of the Bureau of Internal Revenue. Not long later, the bureau was renamed the Internal Revenue Service.[16]

In 1954 the filing deadline was moved from March 15 to Apr 15.

The Taxation Reform Act of 1969 created the Alternative Minimum Tax.

Past 1986, express electronic filing of tax returns was possible.

The Internal Acquirement Service Restructuring and Reform Act of 1998 ("RRA 98") changed the organization from geographically oriented to an system based on four operating divisions.[17] It added "10 deadly sins" that require immediate termination of IRS employees plant to have committed certain misconduct.[18]

Enforcement activities declined. The IRS Oversight Board noted that the pass up in enforcement activities has "rais[ed] questions most tax compliance and fairness to the vast majority of citizens who pay all their taxes".[19] In June 2012, the IRS Oversight Board recommended to Treasury a fiscal yr 2014 budget of $thirteen.074billion for the Internal Revenue Service.[twenty]

On December 20, 2017, Congress passed the Tax Cuts and Jobs Act of 2017. Information technology was signed into law by President Trump on December 22, 2017.

In the 2017 fiscal yr, the IRS had 76,832 employees conducting its work, a decrease of 14.9 pct from 2012.[21]

Presidential tax returns (1973) [edit]

From the 1950s through the 1970s, the IRS began using engineering science such as microfilm to keep and organize records. Access to this information proved controversial, when President Richard Nixon's tax returns were leaked to the public. His taxation advisor, Edward L. Morgan, became the fourth police-enforcement official to be charged with a crime during Watergate.[22]

John Requard, Jr., defendant of leaking the Nixon tax returns, collected delinquent taxes in the slums of Washington. In his words: "We went afterward people for nickels and dimes, many of them poor and in many cases illiterate people who didn't know how to deal with a government bureau." Requard admitted that he saw the returns, just denied that he leaked them.[23]

Reporter Jack White of The Providence Periodical won the Pulitzer Prize for reporting nearly Nixon'due south tax returns. Nixon, with a salary of $200,000, paid $792.81 in federal income revenue enhancement in 1970 and $878.03 in 1971, with deductions of $571,000 for donating "vice-presidential papers".[24] This was i of the reasons for his famous statement: "Well, I'g not a crook. I've earned everything I've got."

And so controversial was this leak, that most later US presidents released their tax returns (though sometimes merely partially). These returns can exist found online at the Tax History Project.[25]

Computerization (1959–present) [edit]

By the end of the 2nd World State of war, the IRS was treatment 60 million revenue enhancement returns each yr, using a combination of mechanical desk calculators, bookkeeping machines, and pencil and newspaper forms. In 1948 dial card equipment was used. The first trial of a computer organization for income tax processing was in 1955, when an IBM 650 installed at Kansas City candy 1.i million returns. The IRS was authorized to proceed with computerization in 1959, and purchased IBM 1401 and IBM 7070 systems for local and regional data processing centers. The Social Security number was used for taxpayer identification starting in 1965. By 1967, all returns were processed by reckoner and punched carte du jour data entry was phased out.[26]

Information processing in the IRS systems of the late 1960s was in batch style; microfilm records were updated weekly and distributed to regional centers for handling tax inquiries. A project to implement an interactive, realtime system, the "Taxation Administration System", was launched, that would provide thousands of local interactive terminals at IRS offices. Yet, the General Bookkeeping Office prepared a report critical of the lack of protection of privacy in TAS, and the project was abased in 1978.[26]

In 1995, the IRS began to use the public Net for electronic filing. Since the introduction of eastward-filing, cocky-paced online tax services have flourished, augmenting the piece of work of revenue enhancement accountants, who were sometimes replaced.

In 2003, the IRS struck a bargain with tax software vendors: The IRS would not develop online filing software and, in return, software vendors would provide free e-filing to most Americans.[27] In 2009, 70% of filers qualified for free electronic filing of federal returns.[28]

According to an inspector general'due south report, released in Nov 2013, identity theft in the United States is blamed for $fourbillion worth of fraudulent 2012 tax refunds by the IRS. Fraudulent claims were made with the employ of stolen taxpayer identification and Social Security numbers, with returns sent to addresses both in the The states and internationally. Following the release of the findings, the IRS stated that information technology resolved about of the identity theft cases of 2013 within 120 days, while the average time to resolve cases from the 2011/2012 tax period was 312 days.[29] [xxx]

In September 2014, IRS Commissioner John Koskinen expressed business concern over the organization'due south ability to handle Obamacare and administrate premium tax credits that help people pay for wellness plans from the health law's insurance exchanges. It will likewise enforce the police force's individual mandate, which requires about Americans to hold health insurance.[31] In Jan 2015, Fox News obtained an email which predicted a messy taxation season on several fronts. The electronic mail was sent by IRS Commissioner Koskinen to workers. Koskinen predicted the IRS would shut downward operations for two days after this year which would event in unpaid furloughs for employees and service cuts for taxpayers. Koskinen too said delays to IT investments of more than $200million may filibuster new taxpayer protections against identity theft.[30] Also in January 2015, the editorial board of The New York Times chosen the IRS budget cuts penny-wise-and-pound-foolish, where for every dollar of cuts in the upkeep, 6 were lost in taxation revenue.[32]

History of the IRS proper name [edit]

IRS and Section of the Treasury seal on lectern

As early on equally the year 1918, the Agency of Internal Revenue began using the name "Internal Revenue Service" on at least i tax grade.[33] In 1953, the name change to the "Internal Revenue Service" was formalized in Treasury Decision 6038.[34]

Current organization [edit]

The 1980s saw a reorganization of the IRS. A bipartisan commission was created with several mandates, among them to increase customer service and improve collections.[35] Congress later enacted the Internal Revenue Service Restructuring and Reform Human action of 1998.[36]

Because of that Deed, the IRS now functions under iv major operating divisions: Large Business organization and International (LB&I), Small Business/Self-Employed (SB/SE), Wage and Investment (W&I), and Tax Exempt & Government Entities (TE/GE). Effective October 1, 2010, the name of the Big and Mid-Size Business division was changed to the Large Business concern & International (LB&I) division.[37] While there is some evidence that client service has improved, lost tax revenues in 2001 were over $323billion.[38]

The IRS is headquartered in Washington, D.C., and does nigh of its figurer programming in Maryland. It currently operates 3 submission processing centers which process returns sent past post and returns filed electronically via East-file. Dissimilar types of returns are processed at the various centers with some centers processing individual returns and others processing concern returns.

Originally, there were ten submission processing centers beyond the country. In the early 2000s, the IRS closed five centers: Andover, MA; Holtsville, NY; Philadelphia, PA; Atlanta, GA; and Memphis, TN. This left v centers processing returns: Austin, TX; Covington, KY; Fresno, CA; Kansas Urban center, MO; and Ogden, UT. In October 2016 the IRS appear that three more centers will close over a six-year period: Covington, KY in 2019; Fresno, CA in 2021; and Austin, TX in 2024. Currently Kansas Urban center, MO, Ogden, UT and Austin,TX remain open. This will leave Kansas Metropolis, MO and Ogden, UT as the concluding two submission processing centers after 2024.

The IRS as well operates three computer centers around the country (in Detroit, Michigan; Martinsburg, W Virginia; and Memphis, Tennessee).[39]

Commissioner [edit]

The current IRS commissioner is Charles P. Rettig of California. There have been 48 previous commissioners of Internal Acquirement and 28 interim commissioners since the agency's creation in 1862.[40]

From May 22, 2013 to December 23, 2013, senior official at the Function of Management and Budget Daniel Werfel was interim Commissioner of Internal Revenue.[41] Werfel, who attended law school at the University of North Carolina and attained a chief's degree from Duke Academy, prepared the government for a potential shutdown in 2011 by determining which services that would remain in existence.[41] [42]

No IRS commissioner has served more than v years and one month since Guy Helvering, who served 10 years until 1943.[43] The well-nigh recent commissioner to serve the longest term was Doug Shulman, who was appointed by President George W. Bush and served for five years.[43]

Deputy commissioners [edit]

The Commissioner of Internal Revenue is assisted by two deputy commissioners.

The Deputy Commissioner for Operations Support reports straight to the Commissioner and oversees the IRS's integrated support functions, facilitating economy of scale efficiencies and ameliorate business practices. The Deputy Commissioner for Operations Back up provides executive leadership for customer service, processing, tax law enforcement and financial management operations and is responsible for overseeing IRS operations and providing executive leadership on policies, programs and activities. The Deputy assists and acts on behalf of the IRS Commissioner in directing, coordinating and controlling the policies, programs and activities of the IRS; in establishing taxation assistants policy, and developing strategic bug and objectives for IRS strategic management.

The Deputy Commissioner for Services and Enforcement reports directly to the Commissioner and oversees the iv primary operating divisions responsible for the major customer segments and other taxpayer-facing functions. The Deputy Commissioner for Services and Enforcement serves equally the IRS Commissioner'south essential assistant interim on behalf of the commissioner in establishing and enforcing tax administration policy and upholding IRS's mission to provide America'southward taxpayers elevation-quality service by helping them understand and meet their taxation responsibilities.

Office of the Taxpayer Advocate [edit]

The Office of the Taxpayer Advocate, also called the Taxpayer Advocate Service, is an independent office within the IRS responsible for assisting taxpayers in resolving their bug with the IRS and identifying systemic problems that exist within the IRS.[44] The current head of the organisation, known as the Usa Taxpayer Advocate, is Erin M. Collins.[45]

Contained Office of Appeals [edit]

The Independent Office of Appeals is an independent arrangement within the IRS that helps taxpayers resolve their tax disputes through an breezy, administrative process. Its mission is to resolve tax controversies fairly and impartially, without litigation.[46] Resolution of a example in Appeals "could take anywhere from xc days to a year".[47] The current master is Donna C. Hansberry.[48]

Role of Professional Responsibleness (OPR) [edit]

OPR investigates suspected misconduct by attorneys, CPAs and enrolled agents ("tax practitioners") involving practice before the IRS and has the power to impose various penalties. OPR can as well accept action against tax practitioners for confidence of a crime or failure to file their own tax returns. According to erstwhile OPR director Karen Hawkins, "The focus has been on roadkill – the like shooting fish in a barrel cases of revenue enhancement practitioners who are non-filers."[49] The electric current acting director is Elizabeth Kastenberg.[fifty]

Criminal Investigation (CI) [edit]

Internal Revenue Service, Criminal Investigation (IRS-CI) is responsible for investigating potential criminal violations of the U.Due south. Internal Revenue Code and related fiscal crimes, such as coin laundering, currency violations, revenue enhancement-related identity theft fraud, and terrorist financing that adversely affect tax administration. This division is headed past the Chief, Criminal Investigation appointed by the IRS Commissioner.

Programs [edit]

Volunteer Income Revenue enhancement Help (VITA) and Tax Counseling for the Elderly (TCE) are volunteer programs that the IRS runs to train volunteers and provide tax assistance and counseling to taxpayers.[51] Volunteers can study eastward-class material, take tests, and practice using revenue enhancement-training software. Link & Acquire Taxes (searchable by keyword on the IRS website), is the free e-learning portion of VITA/TCE plan for training volunteers.

Structure [edit]

- Commissioner of Internal Revenue

- Deputy Commissioner for Services and Enforcement

- Assistant Deputy Commissioner for Services and Enforcement

- Large Business and International Division – administers taxation laws governing businesses with avails greater than $10million

- Pocket-sized Business/Self-Employed Segmentation – administers tax laws governing small businesses and cocky-employed taxpayers

- Collection – collects delinquent taxes and secures filing of delinquent tax return

- Examination – reviews returns to ensure taxpayers accept complied with their tax responsibilities

- Operations Support – centralized support services

- Wage and Investment Division – administers revenue enhancement laws governing individual wage earners

- Customer Assist, Relationships and Education – aid taxpayers in satisfying their taxation responsibilities

- Return Integrity and Compliance Services – detecting and preventing improper refunds

- Customer Account Services – processing taxpayer returns

- Operations Support – internal management and support services

- Tax Exempt and Government Entities Division – administers tax laws governing governmental and tax exempt entities

- Authorities Entities/Shares Services – manages, directs, and executes nationwide activities for government entities equally well as provides bounded operational back up

- Employee Plans. – administers pension plan tax laws

- Exempt Organizations – determining tax exempt status for organizations and regulating the same through examination and compliance checks

- Criminal Investigation Division – investigates criminal violations of tax laws and other related fiscal crimes

- International Operations – conducts international investigations of fiscal crimes and provides special agent attaches in strategic International locations

- Operations, Policy, and Back up – plans, develops, directs, and implements criminal investigations through regional field offices

- Refund and Cyber Crimes – identifying criminal taxation schemes and conducting cybercrime investigations

- Strategy – internal support services

- Technology Operations and Investigative Services – management of information technology

- Function of Online Services

- Return Preparer Office

- Office of Professional person Responsibility

- Whistleblower Office

- Deputy Commissioner for Operations Back up

- Banana Deputy Commissioner for Operations Back up

- Master, Facilities Direction and Security Services

- Master Information Officer

- Chief Privacy Officer

- Principal Procurement Officer

- Chief Financial Officer

- IRS Human Upper-case letter Officeholder

- Chief Adventure Officer

- Chief Diversity Officer

- Chief Enquiry and Analytics Officer

- Master of Staff

- Chief, Communications and Liaison

- National Taxpayer Advocate

- Chief Counsel

- Principal, IRS Contained Office of Appeals

- Deputy Commissioner for Services and Enforcement

Revenue enhancement collection statistics [edit]

Collections before refunds by type of return, fiscal year 2010

Individual income tax (49.9%)

Employment taxes (35.3%)

Corporate income taxes (eleven.ix%)

Excise taxes (2.0%)

Estate taxes (0.7%)

Other (0.two%)

Summary of collections earlier refunds by type of return, fiscal year 2010:[52]

| Type of return | Number of returns | Gross collections to the nearest million US$ |

|---|---|---|

| Individual Income tax | 141,166,805 | 1,163,688 |

| Employment taxes | 29,493,234 | 824,188 |

| Corporate income tax | 2,355,803 | 277,937 |

| Excise taxes | 836,793 | 47,190 |

| Souvenir revenue enhancement | 286,522 | 2,820 |

| Estate tax | 28,780 | sixteen,931 |

| Full | 174,405,682 | ii,332,754 |

For fiscal yr 2009, the U.South. Congress appropriated spending of approximately $12.624billion of "discretionary budget authority" to operate the Department of the Treasury, of which $11.522billion was allocated to the IRS. The projected estimate of the budget for the IRS for fiscal year 2011 was $12.633billion.[53] By dissimilarity, during Fiscal Year (FY) 2006, the IRS collected more than $2.iitrillion in tax (net of refunds), well-nigh 44 percent of which was owing to the individual income revenue enhancement. This is partially due to the nature of the individual income taxation category, containing taxes nerveless from working class, pocket-sized business organization, cocky-employed, and capital gains. The peak 5% of income earners pay 38.284% of the federal tax collected.[54] [55]

As of 2007, the agency estimates that the United States Treasury is owed $354billion more than the amount the IRS collects.[56] This is known as the tax gap.[57]

The gross tax gap is the amount of true tax liability that is not paid voluntarily and timely. For years 2008–2010, the estimated gross tax gap was $458billion. The net taxation gap is the gross tax gap less tax that will be subsequently collected, either paid voluntarily or as the upshot of IRS administrative and enforcement activities; it is the portion of the gross tax gap that volition not exist paid. It is estimated that $52billion of the gross tax gap was eventually collected resulting in a net tax gap of $406billion.[58]

In 2011, 234 million taxation returns were filed allowing the IRS to collect $2.4trillion out of which $384billion were attributed to mistake or fraud.[59]

Outsourcing collection and tax-assist [edit]

In September 2006, the IRS started to outsource the collection of taxpayers debts to private debt drove agencies. Opponents to this alter note that the IRS will exist handing over personal data to these debt collection agencies, who are being paid between 29% and 39% of the amount collected. Opponents are as well worried nigh the agencies' being paid on percent collected, because information technology volition encourage the collectors to employ pressure level tactics to collect the maximum corporeality. IRS spokesman Terry Lemons responds to these critics proverb the new system "is a sound, counterbalanced program that respects taxpayers' rights and taxpayer privacy". Other state and local agencies as well utilise private collection agencies.[60]

In March 2009, the IRS appear that it would no longer outsource the collection of taxpayers debts to individual debt drove agencies. The IRS decided not to renew contracts to private debt collection agencies, and began a hiring program at its call sites and processing centers across the country to bring on more personnel to process collections internally from taxpayers.[61] As of October 2009, the IRS has ceased using private debt drove agencies.

In September 2009, subsequently undercover exposé videos of questionable activities past staff of one of the IRS's volunteer tax-assistance organizations were fabricated public, the IRS removed ACORN from its volunteer revenue enhancement-assistance plan.[62]

Administrative functions [edit]

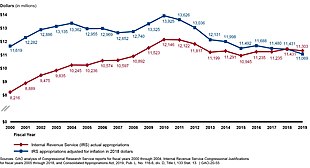

IRS appropriations, 2000–2019

Nominal appropriations

Adjusted for inflation

The IRS publishes tax forms which taxpayers are required to choose from and utilize for calculating and reporting their federal tax obligations. The IRS also publishes a number of forms for its own internal operations, such as Forms 3471 and 4228 (which are used during the initial processing of income tax returns).

In addition to collection of acquirement and pursuing tax cheaters, the IRS problems administrative rulings such as acquirement rulings and private alphabetic character rulings. In improver, the Service publishes the Internal Revenue Bulletin containing the various IRS pronouncements.[63] The controlling authority of regulations and revenue rulings allows taxpayers to rely on them. A letter ruling is good for the taxpayer to whom it is issued, and gives some explanation of the Service's position on a detail tax issue.[64] Additionally, a letter ruling reasonably relied upon by a taxpayer allows for the waiver of penalties for underpayment of revenue enhancement.

As is the case with all administrative pronouncements, taxpayers sometimes litigate the validity of the pronouncements, and courts sometimes determine a particular rule to be invalid where the bureau has exceeded its grant of authorisation. The IRS likewise bug formal pronouncements called Acquirement Procedures, that among other things tell taxpayers how to right prior revenue enhancement errors. The IRS'southward own internal operations manual is the Internal Revenue Transmission, which describes the clerical procedures for processing and auditing tax returns in excruciating detail. For instance, the Internal Revenue Manual contains a special procedure for processing the tax returns of the President and Vice President of the U.s.a..[64]

More than formal rulemaking to requite the Service's interpretation of a statute, or when the statute itself directs that the Secretary of the Treasury shall provide, IRS undergoes the formal regulation process with a Notice of proposed rulemaking (NPRM) published in the Federal Register announcing the proposed regulation, the date of the in-person hearing, and the process for interested parties to have their views heard either in person at the hearing in Washington, D.C., or past mail. Post-obit the statutory period provided in the Authoritative Procedure Act the Service decides on the final regulations "every bit is", or as reflecting changes, or sometimes withdraws the proposed regulations. Generally, taxpayers may rely on proposed regulations until final regulations become constructive. For example, human resources professionals are relying on the October 4, 2005 Proposed Regulations[65] (commendation 70 F.R. 57930-57984)[66] for the Department 409A on deferred compensation (the and then-chosen Enron rules on deferred compensation to add together teeth to the old rules) because regulations accept non been finalized.

The IRS oversaw the Homebuyer Credit and First Time Homebuyer Credit programs instituted by the federal authorities from 2008–2010. Those programs provided United States citizens with money toward the purchase of homes, regardless of income revenue enhancement filings.[67]

Labor union [edit]

Most non-supervisory employees at the IRS are represented by a labor wedlock. The exclusive labor marriage at the IRS is the National Treasury Employees Union (NTEU). Employees are not required to join the spousal relationship or pay dues. The IRS and NTEU have a national collective bargaining agreement.[68]

In pursuing administrative remedies against the IRS for certain unfair or illegal personnel actions, under federal law an IRS employee may choose only 1 of the three forums below:

- NTEU, or

- United States Merit Systems Protection Lath (MSPB), or

- United States Office of Special Counsel (OSC).[69]

Employees are likewise required to report sure misconduct to TIGTA. Federal police prohibits reprisal or retaliation against an employee who reports wrongdoing.[lxx] [71] [72]

Controversies [edit]

The IRS has been defendant of abusive behavior on multiple occasions.[73] [74] [75] [76] Testimony was given before a Senate subcommittee that focused on cases of overly aggressive IRS collection tactics in considering a demand for legislation to give taxpayers greater protection in disputes with the agency.

Congress passed the Taxpayer Pecker of Rights III on July 22, 1998, which shifted the brunt of proof from the taxpayer to the IRS in certain limited situations. The IRS retains the legal authority to enforce liens and seize assets without obtaining judgment in court.[77]

In 2002, the IRS accused James and Pamela Moran, likewise as several others, of conspiracy, filing faux tax returns and mail fraud as part of the Anderson Ark investment scheme. The Morans were somewhen acquitted, and their attorney stated that the government should have realized that the couple was merely duped by those running the scheme.[78]

In 2004, the police licenses of two sometime IRS lawyers were suspended later a federal court ruled that they defrauded the courts so the IRS could win a sum in tax shelter cases.[79]

In 2013, the Internal Revenue Service became embroiled in a political scandal in which it was discovered that the agency subjected conservative or conservative-sounding groups filing for tax-exempt status to extra scrutiny.[80]

On September five, 2014, sixteen months after the scandal first erupted, a Senate Subcommittee released a written report that confirmed that Internal Revenue Service used inappropriate criteria to target Tea Party groups, but found no testify of political bias.[81] The chairman of the Senate Permanent Subcommittee on Investigations confirmed that while the actions were "inappropriate, intrusive, and crushing", the Democrats have ofttimes experienced similar treatment.[82] Republicans noted that 83% of the groups being held up by the IRS were right-leaning; and the Subcommittee Minority staff, which did not join the Majority staff report, filed a dissenting written report entitled, "IRS Targeting Tea Political party Groups".[83]

On May 25, 2015, the agency announced that over several months criminals had accessed the private tax information of more than than 100,000 taxpayers and stolen virtually $50million in fraudulent returns.[84] By providing Social Security numbers and other data obtained from prior computer crimes, the criminals were able to utilise the IRS's online "Become Transcript" function to have the IRS provide them with the tax returns and other private information of American tax filers.[85] On August 17, 2015, IRS disclosed that the breach had compromised an boosted 220,000 taxpayer records.[86] On Feb 27, 2016, the IRS disclosed that more than 700,000 Social Security numbers and other sensitive data had been stolen.[87] [88] [89]

The Internal Revenue Service has been the subject of frequent criticism by many elected officials and candidates for political part, including some who have chosen to cancel the IRS. Amidst them were Ted Cruz, Rand Paul, Ben Carson, Mike Huckabee, and Richard Lugar.[90] In 1998, a Republican congressman introduced a bill to repeal the Internal Revenue Code by 2002.[91] In 2016, The Republican Report Commission, which counts over 2-thirds of House of Representatives Republicans as its members, chosen for "the complete elimination of the IRS", and Republican Representative Rob Woodall of Georgia has introduced a bill every year since he entered Congress in 2011 to eliminate income taxes and cancel the IRS.[92]

The IRS has been criticized for its reliance on legacy software. Systems such as the Individual Master File are more 50 years former and accept been identified by the Government Accountability Office as "facing significant risks due to their reliance on legacy programming languages, outdated hardware, and a shortage of human resources with critical skills".[93]

Run into besides [edit]

- HM Revenue and Customs, the Britain equivalent

- Income Tax Department, Republic of india

- IRS penalties

- Revenue enhancement evasion in the United States

References [edit]

- ^ "Part of Commissioner of Internal Acquirement (Created past an human action of Congress, July i, 1862)". www.irs.gov . Retrieved Oct 21, 2018.

- ^ Internal Revenue Service. "The Agency, its Mission and Statutory Authority". www.irs.gov . Retrieved October 21, 2018.

- ^ "Congressional Budget Justification and Annual Performance Report and Plan Fiscal Year 2020" (PDF). Section of Treasury Internal Revenue Service. Retrieved March three, 2022.

- ^ "Written Testimony of Commissioner Charles P. Rettig before the House Appropriations Commission Subcommittee on Financial Services and Full general Government on the IRS Budget and 2019 filing season Apr 9, 2019 | Internal Revenue Service". www.irs.gov.

- ^ "Affordable Intendance Human action Revenue enhancement Provisions – Internal Revenue Service". www.irs.gov.

- ^ "ACTC letter of the alphabet to Congressional-Leadership" (PDF). www.actconline.org.

- ^ "IRS Nominee Says He's Never Had a Client Under Audit for a Decade". Bloomberg.com. June 28, 2018. Retrieved September xix, 2020.

- ^ "1861–1865: The Civil State of war". Taxation.org. Retrieved August 9, 2010.

- ^ iii U.S. 171 (1796).

- ^ "1866–1900: Reconstruction to the Spanish–American War". Tax.org. Archived from the original on August 14, 2010. Retrieved Baronial 9, 2010.

- ^ "Notes on the Amendments – The U.Due south. Constitution Online". USConstitution.net. Retrieved August 9, 2010.

- ^ "The outset 1040 with instructions" (PDF) . Retrieved November 8, 2011.

- ^ "1901–1932: The Income Taxation Arrives". Tax.org. April 14, 1906. Archived from the original on Baronial 14, 2010. Retrieved Baronial nine, 2010.

- ^ "Historical highlights of the IRS". Retrieved October six, 2017.

- ^ Grote, JoAnn A. (2001). The Internal Revenue Service. Infobase Publishing. p. 43. ISBN0791059898.

- ^ "IRS Historical Fact Book: A Chronology. 1646–1992. Department of the Treasury, Internal Acquirement Service" (PDF). www.governmentattic.org.

This article incorporates text from this source, which is in the public domain .

This article incorporates text from this source, which is in the public domain . - ^ "Treasury Reports". world wide web.treasury.gov.

- ^ "IRS' 10 mortiferous sins to remain deadly". Authorities Executive.

- ^ "Study of the Joint Committee on Taxation Relating to the Internal Revenue Service as Required past the IRS Reform and Restructuring Deed of 1998 (JCX-33-01)" (PDF). Joint Committee on Taxation. May four, 2001. Archived from the original (PDF) on November 13, 2018. Retrieved October 20, 2018.

- ^ "FY2014 IRS Upkeep Recommendation Special Report" (PDF). IRS Oversight Lath. May 2013. Retrieved March 3, 2022.

- ^ Internal Revenue Service. "IRS Budget & Workforce". www.irs.gov . Retrieved February 2, 2019.

- ^ "Investigations: Fraud in Nixon's Taxes". Time. November xviii, 1974. Archived from the original on December 22, 2008. Retrieved May 5, 2010.

- ^ "How an IRS leak changed history altered history". Baltimore Sun. December 21, 2003. Archived from the original on July eleven, 2012. Retrieved August ix, 2010.

- ^ "How an IRS leak changed historyaltered history". The Baltimore Sunday. December 21, 2003. Archived from the original on January eleven, 2012. Retrieved August nine, 2010.

- ^ Tax History Project – Presidential Tax Returns. Taxhistory.org. Retrieved on August 10, 2013.

- ^ a b Paul Cenuzi, A History of Modern Computing, MIT Press, 2003. ISBN 0262532034. pp. 119–122.

- ^ "Complimentary File: Do Your Federal Taxes for Gratuitous". Irs.gov. January 29, 2013. Retrieved February iv, 2013.

- ^ Murray Dixon, Teresa (Feb 21, 2010). "As eastward-filing turns 20, IRS trying to win over remaining tertiary of taxpayers from newspaper returns". The Plain Dealer. Cleveland. Retrieved August 9, 2010.

- ^ "IRS refunded $4 billion to identity thieves last year, inspector general's study says". CBS News. November 7, 2013. Retrieved Nov 10, 2013.

- ^ a b "IRS primary warns of refund delays, poor customer service this taxation year". Fox News. January 15, 2015.

- ^ Howell, Tom. "Bipartisan doubts sally on IRS ability to handle Obamacare". The Washington Times . Retrieved September 11, 2014.

- ^ The Editorial Lath (January 17, 2015). "The Dangerous Erosion of Taxation". The New York Times . Retrieved March 6, 2017.

- ^ Form 1040, Private Income Tax Render for year 1918, as republished in historical documents section of Publication 1796 (Rev. February 2007), Internal Revenue Service, U.S. Department of the Treasury. Form 1040s for years 1918, 1919, and 1920 diameter the proper name "Internal Revenue Service". For the 1921 taxation year, the proper name was dropped, then was re-added for the 1929 tax year.

- ^ 1953-two C.B. 657 (August 21, 1953), filed with Division of the Federal Register on August 26, 1967, 18 Fed. Reg. 5120. Compare Treas. Department Social club 150-29 (July 9, 1953).

- ^ "Official web site of the National Commission on Restructuring the Internal Revenue Service". Firm.gov. Archived from the original on April 29, 2017. Retrieved November eight, 2011.

- ^ Pub. 50. No. 105-206, 112 Stat. 685 (July 22, 1998).

- ^ IR-2010-88, August 4, 2010, "IRS Realigns and Renames Large Business Division, Enhances Focus on International Tax Assistants", Internal Revenue Service, at IRS.gov Archived August 27, 2012, at the Wayback Machine

- ^ "U.Southward. Department of the Treasury, Printing Release" (PDF) (Press release). September 26, 2006. Archived from the original (PDF) on November 26, 2007.

- ^ "GAO-xi-308 Information Security: IRS Needs to Enhance Internal Control over Financial Reporting and Taxpayer Data" (PDF) . Retrieved November 8, 2011.

- ^ "The Commissioner'southward Section". IRS.gov. Archived from the original on April 23, 2016. Retrieved August 10, 2017.

- ^ a b President Obama Appoints Daniel Werfel equally Interim Commissioner of Internal Revenue, May 16, 2013

- ^ Zachary A. Goldfarb; Aaron Blake (May xvi, 2013). "Daniel Werfel replaces Miller equally interim IRS commissioner". The Washington Postal service . Retrieved May 16, 2013.

- ^ a b "IRS Commissioner Says He Doesn't Desire Second Term". Bloomberg.com. Bloomberg. April 5, 2012.

- ^ "IRS Tax Attorney Los Angeles". IRStaxreliefsettlement. Retrieved September 5, 2016.

- ^ "Archived copy". Archived from the original on Oct xvi, 2020. Retrieved August 17, 2019.

{{cite spider web}}: CS1 maint: archived copy as title (link) - ^ "Office of Appeals". US Internal Revenue Service. Retrieved July 5, 2018.

This article incorporates text from this source, which is in the public domain .

This article incorporates text from this source, which is in the public domain . - ^ "What Can You Expect from Appeals – Internal Revenue Service". world wide web.irs.gov.

- ^ "Hansberry" (PDF).

- ^ "Karen Lee Hawkins". law.ggu.edu.

- ^ "The Office of Professional Responsibility (OPR) At-A-Glance". US Internal Revenue Service. Retrieved August 17, 2019.

This article incorporates text from this source, which is in the public domain .

This article incorporates text from this source, which is in the public domain . - ^ "Link & Learn Taxes, linking volunteers to quality e-learning". Irs.gov. Archived from the original on March 17, 2012. Retrieved December 22, 2012.

- ^ "Tax Stats at a Glance". IRS.gov. Archived from the original on May 10, 2012. Retrieved June four, 2012.

- ^ See Table, p. 115, Budget of the U.S. Authorities: Fiscal Twelvemonth 2011, Office of Management and Budget, Executive Part of the President of the United States (U.South. Gov't Printing Office, Washington, 2010), at Whitehouse.gov (PDF)

- ^ "SOI Taxation Stats – Individual Income Revenue enhancement Rates and Tax Shares". irs.gov. Archived from the original on August 6, 2012.

- ^ 'New IRS Data Reveals That the Rich Actually Practice Pay Tax – Lots of Information technology' by John Gaver. Printing Release, Actionamerica.org, October 9, 2007.

- ^ IRS Commissioner Assailed on 'Tax Gap' by Jack Speer. Morning Edition, National Public Radio, March 21, 2006.

- ^ "The Tax Gap – Internal Revenue Service". www.irs.gov.

- ^ "Gross tax gap" (PDF) . Retrieved April 12, 2012.

- ^ USA today page 1B/2B published Apr 12, 2012 "complex tax code raises problems for taxpayers and IRS"

- ^ "IRS plan for private debt drove draws criticism". The San Diego Marriage-Tribune. August 23, 2006. Archived from the original on June two, 2016. Retrieved Apr 30, 2016.

- ^ "IRS Conducts Extensive Review, Decides Not to Renew Individual Debt Collection Contracts" Archived Jan 28, 2016, at the Wayback Machine

- ^ Wheaton, Sarah (September 23, 2008). "Acorn Sues Over Video every bit I.R.S. Severs Ties". The New York Times.

- ^ "Internal Acquirement Message: 2012–23". Internal Revenue Service. June four, 2012. Retrieved June 7, 2012.

- ^ a b Internal Revenue Transmission Section iii.28.3.

- ^ A257.g.akamaitech.cyberspace Archived July 23, 2006, at the Wayback Machine (PDF)

- ^ Federal Register (Volume 70, Number 191) Archived August nineteen, 2006, at the Wayback Machine, October iv, 2005

- ^ "Outset-Time Homebuyer Credit – Internal Acquirement Service". world wide web.irs.gov.

- ^ "2019 National Understanding: Internal Revenue Service and National Treasury Employees Union" (PDF). National Treasury Employees Union. Retrieved March 3, 2022.

- ^ "Prohibited Personnel Practices (PPPs)". osc.gov. Archived from the original on July 2, 2019. Retrieved October 21, 2018.

- ^ "What is TIGTA". Treasury Inspector Full general for Tax Administration. U.Southward. Department of the Treasury. December 11, 2014. Retrieved Oct 21, 2018.

- ^ "§ 2302. Prohibited personnel practices". U.S. Office of Personnel Direction. Retrieved March 3, 2022.

- ^ "Department of the Treasury Employee Rules of Comport". Federal Register. Feb xix, 2016.

- ^ "Prepared Statement Of Witness Before The Senate Finance Committee Oversight Hearing On The Internal Revenue Service". Archived from the original on July 29, 2007. Retrieved June 17, 2007.

- ^ Davis, Robert Edwin. "Argument earlier the Senate Committee on Finance". Archived from the original on Feb nine, 2007. Retrieved June 17, 2007.

- ^ Schriebman, Robert. "Prepared Statement of Robert Due south. Schrieman Before the Senate Finance Committee". Archived from the original on Oct 18, 2007. Retrieved June 17, 2007.

- ^ Davis, Shelley L. (September 23, 1997). "Prepared Argument of Shelley Fifty. Davis Earlier the Senate Finance Commission Oversight Hearing On The Internal Revenue Service". Archived from the original on May 5, 2007. Retrieved June 17, 2007.

- ^ Run across 26 U.S.C. § 6331. For case police on department 6331, see Brian v. Gugin, 853 F. Supp. 358, 94–1 U.S. Tax Cas. (CCH) paragr. fifty,278 (D. Idaho 1994), aff'd, 95-ane U.S. Tax Cas. (CCH) paragr. 50,067 (ninth Cir. 1995).

- ^ "Couple acquitted of tax fraud". The Seattle Times. January 4, 2008. Retrieved November 16, 2017.

- ^ Johnston, David Cay (Baronial 21, 2004). "2 Ex-I.R.Southward. Lawyers' Licenses Suspended for Misconduct". The New York Times. ISSN 0362-4331. Retrieved Nov 16, 2017.

- ^ "IRS officials in Washington were involved in targeting of conservative groups". The Washington Post . Retrieved May fifteen, 2013.

- ^ Korte, Gregory. "Senate subcommittee: No political bias in IRS targeting". The states Today . Retrieved September x, 2014.

- ^ The Permanent Subcommittee On Investigations. "RS and TIGTA Management Failures Related to 501(c)(iv) Applicants Engaged in Entrada Activity". Retrieved September 10, 2014.

- ^ The Subcommittee Minority. "IRS Targeting Tea Party Groups" (PDF) . Retrieved September x, 2014.

- ^ Waddell, Kaveh (February 26, 2016). "The IRS Hack Was Twice as Bad equally We Idea". The Atlantic . Retrieved November 22, 2020.

- ^ Steinberg, Joseph. "IRS Leaked Over 100,000 Taxpayers' Private Info To Criminals: What You Demand". Forbes . Retrieved May 27, 2015.

- ^ Weise, Elizabeth (August 17, 2015). "IRS hack far larger than first thought". United states Today. Retrieved Baronial 17, 2015.

- ^ "Massive IRS data breach much bigger than first idea". CBS News. Apr 18, 2016. Retrieved April 18, 2016.

- ^ "Hack Brief: Last Twelvemonth's IRS Hack Was Manner Worse Than We Realized". Wired. ISSN 1059-1028. Retrieved November 22, 2020 – via world wide web.wired.com.

- ^ McCoy, Kevin. "Cyber hack got access to over 700,000 IRS accounts". Us TODAY . Retrieved November 22, 2020.

- ^ "A globe with no IRS? Actually". CNN Money. Nov 4, 2015. Retrieved February 11, 2020.

- ^ "How the IRS Was Gutted". ProPublica. December xi, 2018. Retrieved February eleven, 2020.

- ^ "Conservatives in Congress urge shutdown of IRS". Reuters. May two, 2016. Retrieved February 11, 2020.

- ^ Usa Government Accountability Office (June 28, 2018). IRS Needs to Take Additional Deportment to Address Significant Risks to Tax Processing (Report). GAO-18-298.

Further reading [edit]

- Davis, Shelley L.; Matalin, Mary (1997). Unbridled Ability: Inside the Secret Civilisation of the IRS . New York: Harper Collins. ISBN0-88730-829-five.

- Johnston, David Cay (2003). Perfectly Legal: The Covert Campaign to Rig Our Tax System to Benefit the Super Rich – and Cheat Everybody Else. New York: Portfolio. ISBN1-59184-019-viii.

- Rossotti, Charles O. (2005). Many Unhappy Returns: One Man'southward Quest to Turn Around the About Unpopular Organisation in America. Cambridge: Harvard Business School Press. ISBN1-59139-441-iv.

- Roth, William V., Jr.; Nixon, William H. (1999). The Ability to Destroy. New York: Atlantic Monthly Press. ISBN0-87113-748-8.

External links [edit]

- Internal Acquirement Service Official website

- Internal Revenue Service in the Federal Annals

Source: https://en.wikipedia.org/wiki/Internal_Revenue_Service

Posted by: garciatheivein74.blogspot.com

0 Response to "How Much Of The Money Taken By The Irs Is Used By The Irs"

Post a Comment